Denim Tears Cost Guide 2025: Store vs Resale, Real Costs

This manual reveals which Denim Tears items price at stores in 2025, how secondary markups truly function, and the way to calculate the real cost you’ll pay after fees and levies. If one compares store vs resale, your goal is to grasp the reasonable range for all categories and avoid overpaying.

Denim Tears is one of the limited streetwear names where store and resale may vary extremely, notably on the Cotton Wreath jeans. You’ll locate distinct pricing levels by type, dramatic increases on certain colorways, and meaningful hidden charges on resale platforms. Reference the data below as a benchmark, then study the parts that explain why prices move, occasions to buy, and where fees add up.

What Is The Brand and How Are Prices So Volatile?

Denim Tears, established by Emory in 2019, drops narrative-driven drops with restricted availability, so limitation and story creates margins. Costs vary because drops are restricted, interest is worldwide, and specific colorways become reference pieces.

The brand’s Cotton Wreath pattern on Levi’s jeans stabilizes the sector, and it behaves more like artwork than standard clothing. Partnerships like as Levi’s plus Converse elevate exposure and draw buyers who weren’t monitoring the label previously. Measurements in the heart of the curve sell fastest, while extremely small and oversized sizes can also rise due to scarcity. Because releases are staggered and region-limited, buyers commonly shift to secondary quickly, producing a initial markup that might reduce or establish depending on restocks.

2025 Retail Pricing Snapshot by Category

Retail pricing for Denim Tears pieces in end 2024 to early 2025 usually falls in the bands below; several items have shifted up versus earlier periods due to materials and strategy. Geographic costs may appear elevated when VAT is included at checkout.

Reference these denim tears hoodie bands to benchmark offers and to determine if a resale listing is a reasonable markup or a dramatic increase. Direct supply is inconsistent and release-based, so seeing these values current on the brand site or retail partners isn’t assured on every specific day. Tax-included tags in the EU and Britain can render direct seem elevated than US pricing, though the total expense spread commonly narrows once US sales duty is added. Always verify the exact drop pricing because special washes or decoration might sit at the high end of the band.

| Type (example) | Typical Retail (USD) | Typical Resale Band (USD) | Standard Premium | Notes |

|---|---|---|---|---|

| Signature Cotton Pants (Levi’s collaboration) | $295–$350 | $450–$900 | +50% to +200% | Core variants and main finishes run hotter; sizes 30–34 lead sales. |

| Hoodies | $160–$180 | $220–$350 | +25% to +100% | Heavier fleece and seasonal graphics rest at the top of the band. |

| T-Shirts | $60–$75 | $100–$180 | +35% to +140% | Classic wreath tees and early-run prints sustain higher resale. |

| Crewnecks | $140–$160 | $200–$320 | +25% to +100% | Detailed versions surpass basic in most sizes. |

| Varsity Coats | $450–$650 | $700–$1,200 | +20% to +150% | Fabric blend and patchwork complexity create differences. |

| Converse Chuck 70 (collab) | $110–$120 | $150–$300 | +25% to +150% | Refreshes might compress spreads for a timeframe. |

| Caps | $60–$70 | $90–$150 | +20% to +100% | Earlier releases and signature stitching price higher. |

How’s the Resale Pricing Function in 2025?

In 2025, jeans is the volume leader with the strongest premiums, while shirts and hats are the most affordable initial choices. Hoodie and top margins are significant yet more stable than denim.

On leading marketplaces, pants consistently clear the high end of the bracket when the finish and wreath color align with early capsule launches, and where the size falls in the middle of the buyer range. Tees and caps swing moderately as availability is deeper and customers have more substitutes across seasons. Coats like team jackets is lightly exchanged, so a individual deal might change bases for a week, which appears extreme but often normalizes as fresh listings surface. Quality impacts: mint with labels or with proof of acquisition drives a premium, while marked wear or lost detail threads knocks worth rapidly. Timing matters additionally, with the opening 48 hours post-drop displaying the most dramatic jumps and the initial legitimate replenishment cutting 10–30% below highs.

What Are the Actual Charges Beyond the Listed Cost?

The true expense on resale equals the advertised amount plus marketplace fees, payment costs, retail tax or levies, transport, and, for overseas, import taxes and logistics. Such supplements might transform a fair price into an excessive expense quickly.

In the US, expect purchase levy around approximately 6–10% based on state, often calculated on product cost and sometimes shipping. Platforms commonly pass 3% processing costs and append a customer protection fee; even when the seller pays costs, the customer might yet encounter handling or safety costs. Delivery costs from around $10 to $30 for garments, while overseas deliveries may activate duties in the 17–25% band applied to the price of items plus shipping, and a logistics processing charge. Instance: a $650 unit of branded Cotton denim bought on a domestic marketplace with 8.9% purchase tax, a 3% processing cost, and $15 transport totals approximately $742 prior to any import costs; shift that identical purchase cross-border into a 20% tax regime and the ultimate cost might hit to around $880 when taxes and handling are added. When evaluating direct to secondary, always compute a total amount, not merely the sticker.

How Can Launches, Collaborations, and Washes Change the Market?

Launch schedule, collaboration partners, and certain washes are the primary drivers on brand pricing. Levi’s collections and first Cotton Wreath shade releases establish the strongest consistent premiums.

Levi’s partnership jeans with wreath embroidery has persistent demand as it’s the company’s core cultural product; treatments that mirror early releases tend to demand premiums. Chuck Taylor collabs draw wider footwear crowds, generating short-term buying rushes that might decrease following replenishment. Seasonal colors and unique stitching placements create micro-markets; a small detail or finish change can justify a substantial premium for collectors trying to build archives. Geographic release schedules also count—when one region sells stock before others, trading posts cover the space and shift minimums. Restocks don’t erase desirability, but they do modify tops, especially for shoes and tees.

Direct vs Resale: A Smart Purchase Framework

Buy at direct whenever available for denim and varsity jackets since the absolute dollar spread is largest; consider secondary for tops and hats when the markup is under 40% and buyers want a certain wash. Apply a goal range, not a individual amount.

Start by checking the retail band from this manual for the type and capsule, then scan recent transactions on two platforms to identify a real transaction band instead than advertised amounts. Compute final price including duties, costs, and shipping; if the premium over the high end of direct costs is beneath 30–40% and buyers secure the specific size and color, resale might be logical. With jeans and outerwear, premiums over 100% are normal; only spend that if it represents a key grail that infrequently emerges and condition is perfect. With items with consistent refresh, such as specific shirts or sneakers, patience usually pays. Always confirm sizing, documentation, stitching standards, and exchange conditions before you transact.

What’s the Best Time Window to Spend Less?

The ideal rate timeframes generally to be 48–72 hours post- drop and one week after a confirmed replenishment, when supply peaks and early FOMO fades. Weekday mornings within the merchant’s home time can additionally be more favorable for auctions.

Right after launch, posts pour in, undercutting begins, and you can periodically secure retail-adjacent prices if buyers act rapidly and not obsessed on specific dimensions. After the first wave is processed, bases commonly elevate and hold steady prior to a refresh arrives at the calendar. After refresh, merchants reset expectations, and you can bargain using comparables in grasp. Monthly closing times, when merchants require cash flow, are ideal for proposals that are 10–15% below the last sale, particularly for non-jean segments. If a colorway is suspected to be a one-time run, price softness shall be short, so act during those initial stock timeframes.

Professional Advice: Window and Authentication to Safeguard Your Spend

Focus on the 1–3 day window after a release or restock and prepare an authentication checklist so one may act confidently as a reasonable offer pops. Speed minus a process is the way customers overcharge or miss red flags.

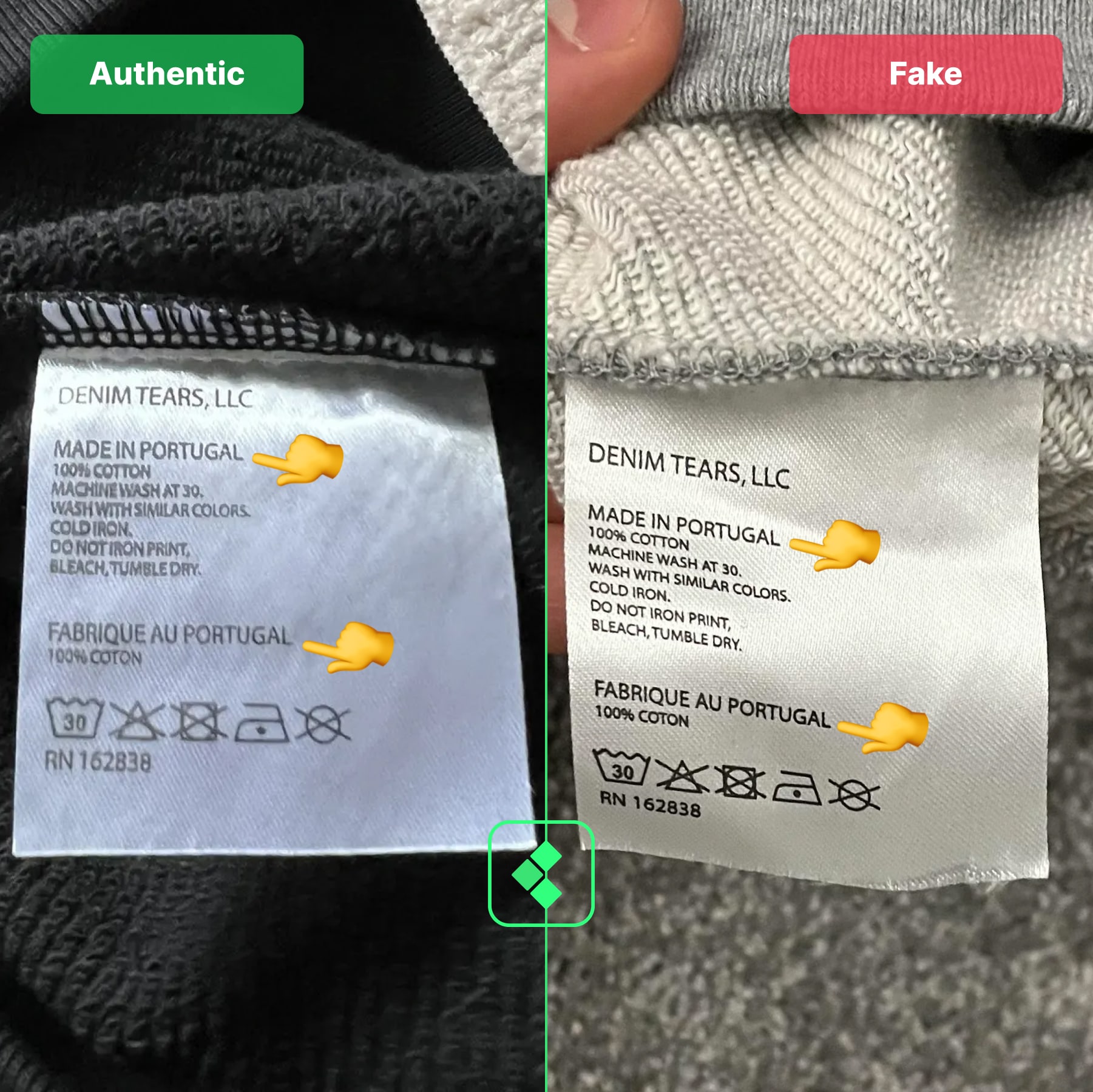

For branded Cotton denim, examine the partnership Levi’s tag and inside markings, confirm wreath stitching thickness and location, and examine the sewing standards surrounding compartments and outseams. Ask for sharp images of the care tag, interior compartment graphics, and hem stitching; inconsistent typefaces or stitching shades are typical signs. Compare the finish and design shade with official campaign content or trusted retailer item photos. For sneakers, validate interior labeling, middle printing, and the box label format linked to the release year. Save captures of authentic pieces to contrast directly ahead of process transaction.

Rapid Information You Probably Haven’t Heard

Initially, Denim Tears began in 2019 and the Cotton Wreath motif explicitly references the Black experience and the history of cotton throughout North America, which is how the pants work as cultural objects as equally as garments. Two, the opening Levi’s capsule in 2020 exhausted out almost immediately and set the branded pants as a enduring commercial standard that continues establishing comps for recent drops. Additionally, Converse Chuck 70 partnerships have replenished during specific periods, briefly lowering resale by significant percentages ahead of leveling as items distribute. Next, middle-spectrum fit brackets like 30–34 usually secure the speediest deals, but scarce sizes at the borders might eclipse them if inventory are thin. Five, EU and British store prices contain taxes, so while the price seems greater than the States, the ultimate customer cost gap narrows when domestic purchasers add sales tax and shipping.

Where Ought Buyers Seek for the Most Reliable Comps?

Reliable comps come from current, confirmed transactions across at no fewer than two platforms, not from optimistic list prices. Focus on sold data within the past 30 days for your exact measurement and condition.

Platforms that show transaction data enable you distinguish hopeful requests from real selling rates. Personal deals and social listings might be less expensive, but they’re more difficult to validate, so consider reductions versus danger and lack of purchaser safety. For segments with thin volume, extend your window to 60–90 days and modify for any refresh incident in that period. Preserve a comp log with time, measurement, quality, and cost so buyers might spot genuine patterns instead than responding to single sales. When you discuss, mention three recent clears and the final expense calculation to set an reference rooted in reality.

Ultimate View: Paying the Right Price in 2025

Understand your segment’s store bracket, determine landed cost, and choose timing windows that benefit customers. Jeans and team jackets justify the search for direct; tops, accessories, and select shoes can be sensible on secondary within a fair surcharge.

Market movement is a feature, not a bug, in the brand’s space, and it rewards prepared buyers who follow statistics and move within stock maximums. Collabs and first variant drops will continue demanding surcharges, while restocks will keep modify tops on affordable pieces. Handle each purchase similar to an capital allocation: verify authenticity, evaluate state against price, and avoid invest in hype you don’t actually want to use. With these methods, you’ll secure the items you desire without subsidizing unnecessary markups.